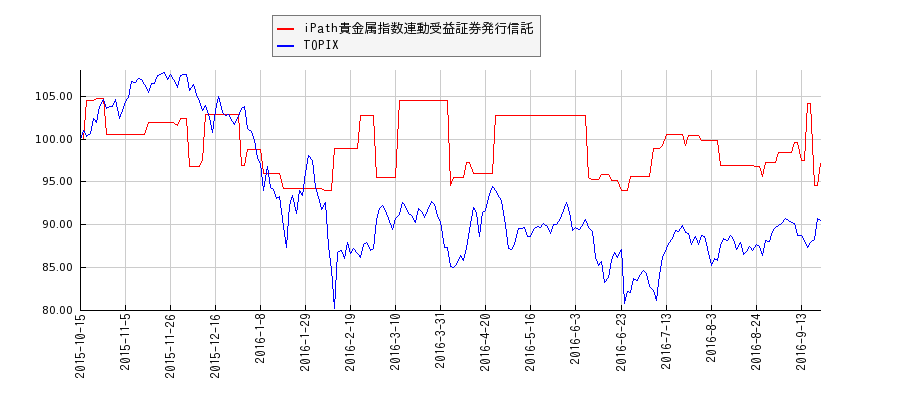

iPath貴金属指数連動受益証券発行信託とTOPIXのパフォーマンス比較

「iPath貴金属指数連動受益証券発行信託(2022)」終値を赤の折れ線チャートで表示し、「TOPIX(TOPIX)」の終値を青の折れ線チャートで表示しています。チャートの期間は1年です。縦軸の目盛りは起点を100とした指数で表示しています。

ほかの指数と比較する

パフォーマンス

(1):iPath貴金属指数連動受益証券発行信託 (2):TOPIX

※PF:2015年10月15日の終値に対して何%値上がりしたかを示しています

両指数の終値は、日本円に変換したものを表示しています。

| 日付 | (1)終値 | (2)終値 | (1)前日比 | (2)前日比 | (1)騰落率 | (2)騰落率 | (1)PF | (2)PF |

| 2015年10月15日 | 5540 | 1490 | - | - | - | - | - | - |

| 2015年10月16日 | 5540 | 1505 | 0 | 15 | 0 | 1.01 | 0 | 1.01 |

| 2015年10月19日 | 5790 | 1494 | 250 | -11 | 4.51 | -0.73 | 4.51 | 0.27 |

| 2015年10月20日 | 5790 | 1499 | 0 | 5 | 0 | 0.33 | 4.51 | 0.6 |

| 2015年10月21日 | 5790 | 1526 | 0 | 27 | 0 | 1.8 | 4.51 | 2.42 |

| 2015年10月22日 | 5800 | 1518 | 10 | -8 | 0.17 | -0.52 | 4.69 | 1.88 |

| 2015年10月23日 | 5800 | 1547 | 0 | 29 | 0 | 1.91 | 4.69 | 3.83 |

| 2015年10月26日 | 5800 | 1558 | 0 | 11 | 0 | 0.71 | 4.69 | 4.56 |

| 2015年10月27日 | 5570 | 1543 | -230 | -15 | -3.97 | -0.96 | 0.54 | 3.56 |

| 2015年10月28日 | 5570 | 1547 | 0 | 4 | 0 | 0.26 | 0.54 | 3.83 |

| 2015年10月29日 | 5570 | 1547 | 0 | 0 | 0 | 0 | 0.54 | 3.83 |

| 2015年10月30日 | 5570 | 1558 | 0 | 11 | 0 | 0.71 | 0.54 | 4.56 |

| 2015年11月2日 | 5570 | 1526 | 0 | -32 | 0 | -2.05 | 0.54 | 2.42 |

| 2015年11月4日 | 5570 | 1540 | 0 | 14 | 0 | 0.92 | 0.54 | 3.36 |

| 2015年11月5日 | 5570 | 1555 | 0 | 15 | 0 | 0.97 | 0.54 | 4.36 |

| 2015年11月6日 | 5570 | 1563 | 0 | 8 | 0 | 0.51 | 0.54 | 4.9 |

| 2015年11月9日 | 5570 | 1590 | 0 | 27 | 0 | 1.73 | 0.54 | 6.71 |

| 2015年11月10日 | 5570 | 1589 | 0 | -1 | 0 | -0.06 | 0.54 | 6.64 |

| 2015年11月11日 | 5570 | 1595 | 0 | 6 | 0 | 0.38 | 0.54 | 7.05 |

| 2015年11月12日 | 5570 | 1593 | 0 | -2 | 0 | -0.13 | 0.54 | 6.91 |

| 2015年11月13日 | 5570 | 1585 | 0 | -8 | 0 | -0.5 | 0.54 | 6.38 |

| 2015年11月16日 | 5650 | 1571 | 80 | -14 | 1.44 | -0.88 | 1.99 | 5.44 |

| 2015年11月17日 | 5650 | 1586 | 0 | 15 | 0 | 0.95 | 1.99 | 6.44 |

| 2015年11月18日 | 5650 | 1586 | 0 | 0 | 0 | 0 | 1.99 | 6.44 |

| 2015年11月19日 | 5650 | 1600 | 0 | 14 | 0 | 0.88 | 1.99 | 7.38 |

| 2015年11月20日 | 5650 | 1603 | 0 | 3 | 0 | 0.19 | 1.99 | 7.58 |

| 2015年11月24日 | 5650 | 1605 | 0 | 2 | 0 | 0.12 | 1.99 | 7.72 |

| 2015年11月25日 | 5650 | 1594 | 0 | -11 | 0 | -0.69 | 1.99 | 6.98 |

| 2015年11月26日 | 5650 | 1602 | 0 | 8 | 0 | 0.5 | 1.99 | 7.52 |

| 2015年11月27日 | 5650 | 1594 | 0 | -8 | 0 | -0.5 | 1.99 | 6.98 |

| 2015年11月30日 | 5630 | 1580 | -20 | -14 | -0.35 | -0.88 | 1.62 | 6.04 |

| 2015年12月1日 | 5670 | 1601 | 40 | 21 | 0.71 | 1.33 | 2.35 | 7.45 |

| 2015年12月2日 | 5670 | 1602 | 0 | 1 | 0 | 0.06 | 2.35 | 7.52 |

| 2015年12月3日 | 5670 | 1602 | 0 | 0 | 0 | 0 | 2.35 | 7.52 |

| 2015年12月4日 | 5360 | 1574 | -310 | -28 | -5.47 | -1.75 | -3.25 | 5.64 |

| 2015年12月7日 | 5360 | 1585 | 0 | 11 | 0 | 0.7 | -3.25 | 6.38 |

| 2015年12月8日 | 5360 | 1568 | 0 | -17 | 0 | -1.07 | -3.25 | 5.23 |

| 2015年12月9日 | 5360 | 1555 | 0 | -13 | 0 | -0.83 | -3.25 | 4.36 |

| 2015年12月10日 | 5400 | 1540 | 40 | -15 | 0.75 | -0.96 | -2.53 | 3.36 |

| 2015年12月11日 | 5700 | 1549 | 300 | 9 | 5.56 | 0.58 | 2.89 | 3.96 |

| 2015年12月14日 | 5700 | 1527 | 0 | -22 | 0 | -1.42 | 2.89 | 2.48 |

| 2015年12月15日 | 5700 | 1502 | 0 | -25 | 0 | -1.64 | 2.89 | 0.81 |

| 2015年12月16日 | 5700 | 1540 | 0 | 38 | 0 | 2.53 | 2.89 | 3.36 |

| 2015年12月17日 | 5700 | 1564 | 0 | 24 | 0 | 1.56 | 2.89 | 4.97 |

| 2015年12月18日 | 5700 | 1537 | 0 | -27 | 0 | -1.73 | 2.89 | 3.15 |

| 2015年12月21日 | 5700 | 1531 | 0 | -6 | 0 | -0.39 | 2.89 | 2.75 |

| 2015年12月22日 | 5700 | 1533 | 0 | 2 | 0 | 0.13 | 2.89 | 2.89 |

| 2015年12月24日 | 5700 | 1523 | 0 | -10 | 0 | -0.65 | 2.89 | 2.21 |

| 2015年12月25日 | 5700 | 1516 | 0 | -7 | 0 | -0.46 | 2.89 | 1.74 |

| 2015年12月28日 | 5700 | 1529 | 0 | 13 | 0 | 0.86 | 2.89 | 2.62 |

| 2015年12月29日 | 5370 | 1543 | -330 | 14 | -5.79 | 0.92 | -3.07 | 3.56 |

| 2015年12月30日 | 5370 | 1547 | 0 | 4 | 0 | 0.26 | -3.07 | 3.83 |

| 2016年1月4日 | 5470 | 1509 | 100 | -38 | 1.86 | -2.46 | -1.26 | 1.28 |

| 2016年1月5日 | 5470 | 1504 | 0 | -5 | 0 | -0.33 | -1.26 | 0.94 |

| 2016年1月6日 | 5470 | 1488 | 0 | -16 | 0 | -1.06 | -1.26 | -0.13 |

| 2016年1月7日 | 5470 | 1457 | 0 | -31 | 0 | -2.08 | -1.26 | -2.21 |

| 2016年1月8日 | 5470 | 1447 | 0 | -10 | 0 | -0.69 | -1.26 | -2.89 |

| 2016年1月12日 | 5320 | 1401 | -150 | -46 | -2.74 | -3.18 | -3.97 | -5.97 |

| 2016年1月13日 | 5320 | 1442 | 0 | 41 | 0 | 2.93 | -3.97 | -3.22 |

| 2016年1月14日 | 5320 | 1406 | 0 | -36 | 0 | -2.5 | -3.97 | -5.64 |

| 2016年1月15日 | 5320 | 1402 | 0 | -4 | 0 | -0.28 | -3.97 | -5.91 |

| 2016年1月18日 | 5320 | 1387 | 0 | -15 | 0 | -1.07 | -3.97 | -6.91 |

| 2016年1月19日 | 5320 | 1390 | 0 | 3 | 0 | 0.22 | -3.97 | -6.71 |

| 2016年1月20日 | 5220 | 1338 | -100 | -52 | -1.88 | -3.74 | -5.78 | -10.2 |

| 2016年1月21日 | 5220 | 1301 | 0 | -37 | 0 | -2.77 | -5.78 | -12.68 |

| 2016年1月22日 | 5220 | 1374 | 0 | 73 | 0 | 5.61 | -5.78 | -7.79 |

| 2016年1月25日 | 5220 | 1392 | 0 | 18 | 0 | 1.31 | -5.78 | -6.58 |

| 2016年1月26日 | 5220 | 1360 | 0 | -32 | 0 | -2.3 | -5.78 | -8.72 |

| 2016年1月27日 | 5220 | 1400 | 0 | 40 | 0 | 2.94 | -5.78 | -6.04 |

| 2016年1月28日 | 5220 | 1392 | 0 | -8 | 0 | -0.57 | -5.78 | -6.58 |

| 2016年1月29日 | 5220 | 1432 | 0 | 40 | 0 | 2.87 | -5.78 | -3.89 |

| 2016年2月1日 | 5220 | 1462 | 0 | 30 | 0 | 2.09 | -5.78 | -1.88 |

| 2016年2月2日 | 5220 | 1452 | 0 | -10 | 0 | -0.68 | -5.78 | -2.55 |

| 2016年2月3日 | 5220 | 1406 | 0 | -46 | 0 | -3.17 | -5.78 | -5.64 |

| 2016年2月4日 | 5220 | 1388 | 0 | -18 | 0 | -1.28 | -5.78 | -6.85 |

| 2016年2月5日 | 5220 | 1368 | 0 | -20 | 0 | -1.44 | -5.78 | -8.19 |

| 2016年2月8日 | 5210 | 1380 | -10 | 12 | -0.19 | 0.88 | -5.96 | -7.38 |

| 2016年2月9日 | 5210 | 1304 | 0 | -76 | 0 | -5.51 | -5.96 | -12.48 |

| 2016年2月10日 | 5210 | 1264 | 0 | -40 | 0 | -3.07 | -5.96 | -15.17 |

| 2016年2月12日 | 5480 | 1196 | 270 | -68 | 5.18 | -5.38 | -1.08 | -19.73 |

| 2016年2月15日 | 5480 | 1292 | 0 | 96 | 0 | 8.03 | -1.08 | -13.29 |

| 2016年2月16日 | 5480 | 1297 | 0 | 5 | 0 | 0.39 | -1.08 | -12.95 |

| 2016年2月17日 | 5480 | 1282 | 0 | -15 | 0 | -1.16 | -1.08 | -13.96 |

| 2016年2月18日 | 5480 | 1311 | 0 | 29 | 0 | 2.26 | -1.08 | -12.01 |

| 2016年2月19日 | 5480 | 1291 | 0 | -20 | 0 | -1.53 | -1.08 | -13.36 |

| 2016年2月22日 | 5480 | 1300 | 0 | 9 | 0 | 0.7 | -1.08 | -12.75 |

| 2016年2月23日 | 5480 | 1291 | 0 | -9 | 0 | -0.69 | -1.08 | -13.36 |

| 2016年2月24日 | 5690 | 1284 | 210 | -7 | 3.83 | -0.54 | 2.71 | -13.83 |

| 2016年2月25日 | 5690 | 1307 | 0 | 23 | 0 | 1.79 | 2.71 | -12.28 |

| 2016年2月26日 | 5690 | 1311 | 0 | 4 | 0 | 0.31 | 2.71 | -12.01 |

| 2016年2月29日 | 5690 | 1297 | 0 | -14 | 0 | -1.07 | 2.71 | -12.95 |

| 2016年3月1日 | 5690 | 1300 | 0 | 3 | 0 | 0.23 | 2.71 | -12.75 |

| 2016年3月2日 | 5290 | 1349 | -400 | 49 | -7.03 | 3.77 | -4.51 | -9.46 |

| 2016年3月3日 | 5290 | 1369 | 0 | 20 | 0 | 1.48 | -4.51 | -8.12 |

| 2016年3月4日 | 5290 | 1375 | 0 | 6 | 0 | 0.44 | -4.51 | -7.72 |

| 2016年3月7日 | 5290 | 1361 | 0 | -14 | 0 | -1.02 | -4.51 | -8.66 |

| 2016年3月8日 | 5290 | 1347 | 0 | -14 | 0 | -1.03 | -4.51 | -9.6 |

| 2016年3月9日 | 5290 | 1332 | 0 | -15 | 0 | -1.11 | -4.51 | -10.6 |

| 2016年3月10日 | 5290 | 1352 | 0 | 20 | 0 | 1.5 | -4.51 | -9.26 |

| 2016年3月11日 | 5790 | 1359 | 500 | 7 | 9.45 | 0.52 | 4.51 | -8.79 |

| 2016年3月14日 | 5790 | 1379 | 0 | 20 | 0 | 1.47 | 4.51 | -7.45 |

| 2016年3月15日 | 5790 | 1372 | 0 | -7 | 0 | -0.51 | 4.51 | -7.92 |

| 2016年3月16日 | 5790 | 1360 | 0 | -12 | 0 | -0.87 | 4.51 | -8.72 |

| 2016年3月17日 | 5790 | 1358 | 0 | -2 | 0 | -0.15 | 4.51 | -8.86 |

| 2016年3月18日 | 5790 | 1345 | 0 | -13 | 0 | -0.96 | 4.51 | -9.73 |

| 2016年3月22日 | 5790 | 1369 | 0 | 24 | 0 | 1.78 | 4.51 | -8.12 |

| 2016年3月23日 | 5790 | 1364 | 0 | -5 | 0 | -0.37 | 4.51 | -8.46 |

| 2016年3月24日 | 5790 | 1354 | 0 | -10 | 0 | -0.73 | 4.51 | -9.13 |

| 2016年3月25日 | 5790 | 1366 | 0 | 12 | 0 | 0.89 | 4.51 | -8.32 |

| 2016年3月28日 | 5790 | 1381 | 0 | 15 | 0 | 1.1 | 4.51 | -7.32 |

| 2016年3月29日 | 5790 | 1377 | 0 | -4 | 0 | -0.29 | 4.51 | -7.58 |

| 2016年3月30日 | 5790 | 1356 | 0 | -21 | 0 | -1.53 | 4.51 | -8.99 |

| 2016年3月31日 | 5790 | 1347 | 0 | -9 | 0 | -0.66 | 4.51 | -9.6 |

| 2016年4月1日 | 5790 | 1301 | 0 | -46 | 0 | -3.41 | 4.51 | -12.68 |

| 2016年4月4日 | 5790 | 1302 | 0 | 1 | 0 | 0.08 | 4.51 | -12.62 |

| 2016年4月5日 | 5240 | 1268 | -550 | -34 | -9.5 | -2.61 | -5.42 | -14.9 |

| 2016年4月6日 | 5290 | 1267 | 50 | -1 | 0.95 | -0.08 | -4.51 | -14.97 |

| 2016年4月7日 | 5290 | 1272 | 0 | 5 | 0 | 0.39 | -4.51 | -14.63 |

| 2016年4月8日 | 5290 | 1287 | 0 | 15 | 0 | 1.18 | -4.51 | -13.62 |

| 2016年4月11日 | 5290 | 1279 | 0 | -8 | 0 | -0.62 | -4.51 | -14.16 |

| 2016年4月12日 | 5390 | 1299 | 100 | 20 | 1.89 | 1.56 | -2.71 | -12.82 |

| 2016年4月13日 | 5390 | 1332 | 0 | 33 | 0 | 2.54 | -2.71 | -10.6 |

| 2016年4月14日 | 5320 | 1371 | -70 | 39 | -1.3 | 2.93 | -3.97 | -7.99 |

| 2016年4月15日 | 5320 | 1361 | 0 | -10 | 0 | -0.73 | -3.97 | -8.66 |

| 2016年4月18日 | 5320 | 1320 | 0 | -41 | 0 | -3.01 | -3.97 | -11.41 |

| 2016年4月19日 | 5320 | 1363 | 0 | 43 | 0 | 3.26 | -3.97 | -8.52 |

| 2016年4月20日 | 5320 | 1365 | 0 | 2 | 0 | 0.15 | -3.97 | -8.39 |

| 2016年4月21日 | 5320 | 1393 | 0 | 28 | 0 | 2.05 | -3.97 | -6.51 |

| 2016年4月22日 | 5320 | 1407 | 0 | 14 | 0 | 1.01 | -3.97 | -5.57 |

| 2016年4月25日 | 5690 | 1401 | 370 | -6 | 6.95 | -0.43 | 2.71 | -5.97 |

| 2016年4月26日 | 5690 | 1391 | 0 | -10 | 0 | -0.71 | 2.71 | -6.64 |

| 2016年4月27日 | 5690 | 1384 | 0 | -7 | 0 | -0.5 | 2.71 | -7.11 |

| 2016年4月28日 | 5690 | 1340 | 0 | -44 | 0 | -3.18 | 2.71 | -10.07 |

| 2016年5月2日 | 5690 | 1299 | 0 | -41 | 0 | -3.06 | 2.71 | -12.82 |

| 2016年5月6日 | 5690 | 1298 | 0 | -1 | 0 | -0.08 | 2.71 | -12.89 |

| 2016年5月9日 | 5690 | 1306 | 0 | 8 | 0 | 0.62 | 2.71 | -12.35 |

| 2016年5月10日 | 5690 | 1334 | 0 | 28 | 0 | 2.14 | 2.71 | -10.47 |

| 2016年5月11日 | 5690 | 1334 | 0 | 0 | 0 | 0 | 2.71 | -10.47 |

| 2016年5月12日 | 5690 | 1337 | 0 | 3 | 0 | 0.22 | 2.71 | -10.27 |

| 2016年5月13日 | 5690 | 1320 | 0 | -17 | 0 | -1.27 | 2.71 | -11.41 |

| 2016年5月16日 | 5690 | 1321 | 0 | 1 | 0 | 0.08 | 2.71 | -11.34 |

| 2016年5月17日 | 5690 | 1335 | 0 | 14 | 0 | 1.06 | 2.71 | -10.4 |

| 2016年5月18日 | 5690 | 1338 | 0 | 3 | 0 | 0.22 | 2.71 | -10.2 |

| 2016年5月19日 | 5690 | 1336 | 0 | -2 | 0 | -0.15 | 2.71 | -10.34 |

| 2016年5月20日 | 5690 | 1343 | 0 | 7 | 0 | 0.52 | 2.71 | -9.87 |

| 2016年5月23日 | 5690 | 1338 | 0 | -5 | 0 | -0.37 | 2.71 | -10.2 |

| 2016年5月24日 | 5690 | 1326 | 0 | -12 | 0 | -0.9 | 2.71 | -11.01 |

| 2016年5月25日 | 5690 | 1342 | 0 | 16 | 0 | 1.21 | 2.71 | -9.93 |

| 2016年5月26日 | 5690 | 1342 | 0 | 0 | 0 | 0 | 2.71 | -9.93 |

| 2016年5月27日 | 5690 | 1349 | 0 | 7 | 0 | 0.52 | 2.71 | -9.46 |

| 2016年5月30日 | 5690 | 1366 | 0 | 17 | 0 | 1.26 | 2.71 | -8.32 |

| 2016年5月31日 | 5690 | 1379 | 0 | 13 | 0 | 0.95 | 2.71 | -7.45 |

| 2016年6月1日 | 5690 | 1362 | 0 | -17 | 0 | -1.23 | 2.71 | -8.59 |

| 2016年6月2日 | 5690 | 1331 | 0 | -31 | 0 | -2.28 | 2.71 | -10.67 |

| 2016年6月3日 | 5690 | 1337 | 0 | 6 | 0 | 0.45 | 2.71 | -10.27 |

| 2016年6月6日 | 5690 | 1332 | 0 | -5 | 0 | -0.37 | 2.71 | -10.6 |

| 2016年6月7日 | 5690 | 1340 | 0 | 8 | 0 | 0.6 | 2.71 | -10.07 |

| 2016年6月8日 | 5690 | 1350 | 0 | 10 | 0 | 0.75 | 2.71 | -9.4 |

| 2016年6月9日 | 5290 | 1337 | -400 | -13 | -7.03 | -0.96 | -4.51 | -10.27 |

| 2016年6月10日 | 5280 | 1330 | -10 | -7 | -0.19 | -0.52 | -4.69 | -10.74 |

| 2016年6月13日 | 5280 | 1284 | 0 | -46 | 0 | -3.46 | -4.69 | -13.83 |

| 2016年6月14日 | 5280 | 1271 | 0 | -13 | 0 | -1.01 | -4.69 | -14.7 |

| 2016年6月15日 | 5310 | 1277 | 30 | 6 | 0.57 | 0.47 | -4.15 | -14.3 |

| 2016年6月16日 | 5310 | 1241 | 0 | -36 | 0 | -2.82 | -4.15 | -16.71 |

| 2016年6月17日 | 5310 | 1250 | 0 | 9 | 0 | 0.73 | -4.15 | -16.11 |

| 2016年6月20日 | 5270 | 1279 | -40 | 29 | -0.75 | 2.32 | -4.87 | -14.16 |

| 2016年6月21日 | 5270 | 1293 | 0 | 14 | 0 | 1.09 | -4.87 | -13.22 |

| 2016年6月22日 | 5270 | 1284 | 0 | -9 | 0 | -0.7 | -4.87 | -13.83 |

| 2016年6月23日 | 5210 | 1298 | -60 | 14 | -1.14 | 1.09 | -5.96 | -12.89 |

| 2016年6月24日 | 5210 | 1204 | 0 | -94 | 0 | -7.24 | -5.96 | -19.19 |

| 2016年6月27日 | 5210 | 1225 | 0 | 21 | 0 | 1.74 | -5.96 | -17.79 |

| 2016年6月28日 | 5300 | 1224 | 90 | -1 | 1.73 | -0.08 | -4.33 | -17.85 |

| 2016年6月29日 | 5300 | 1247 | 0 | 23 | 0 | 1.88 | -4.33 | -16.31 |

| 2016年6月30日 | 5300 | 1245 | 0 | -2 | 0 | -0.16 | -4.33 | -16.44 |

| 2016年7月1日 | 5300 | 1254 | 0 | 9 | 0 | 0.72 | -4.33 | -15.84 |

| 2016年7月4日 | 5300 | 1261 | 0 | 7 | 0 | 0.56 | -4.33 | -15.37 |

| 2016年7月5日 | 5300 | 1256 | 0 | -5 | 0 | -0.4 | -4.33 | -15.7 |

| 2016年7月6日 | 5300 | 1234 | 0 | -22 | 0 | -1.75 | -4.33 | -17.18 |

| 2016年7月7日 | 5480 | 1226 | 180 | -8 | 3.4 | -0.65 | -1.08 | -17.72 |

| 2016年7月8日 | 5480 | 1209 | 0 | -17 | 0 | -1.39 | -1.08 | -18.86 |

| 2016年7月11日 | 5480 | 1255 | 0 | 46 | 0 | 3.8 | -1.08 | -15.77 |

| 2016年7月12日 | 5500 | 1285 | 20 | 30 | 0.36 | 2.39 | -0.72 | -13.76 |

| 2016年7月13日 | 5570 | 1300 | 70 | 15 | 1.27 | 1.17 | 0.54 | -12.75 |

| 2016年7月14日 | 5570 | 1311 | 0 | 11 | 0 | 0.85 | 0.54 | -12.01 |

| 2016年7月15日 | 5570 | 1317 | 0 | 6 | 0 | 0.46 | 0.54 | -11.61 |

| 2016年7月19日 | 5570 | 1331 | 0 | 14 | 0 | 1.06 | 0.54 | -10.67 |

| 2016年7月20日 | 5570 | 1330 | 0 | -1 | 0 | -0.08 | 0.54 | -10.74 |

| 2016年7月21日 | 5570 | 1339 | 0 | 9 | 0 | 0.68 | 0.54 | -10.13 |

| 2016年7月22日 | 5500 | 1327 | -70 | -12 | -1.26 | -0.9 | -0.72 | -10.94 |

| 2016年7月25日 | 5560 | 1325 | 60 | -2 | 1.09 | -0.15 | 0.36 | -11.07 |

| 2016年7月26日 | 5560 | 1306 | 0 | -19 | 0 | -1.43 | 0.36 | -12.35 |

| 2016年7月27日 | 5560 | 1321 | 0 | 15 | 0 | 1.15 | 0.36 | -11.34 |

| 2016年7月28日 | 5560 | 1307 | 0 | -14 | 0 | -1.06 | 0.36 | -12.28 |

| 2016年7月29日 | 5530 | 1322 | -30 | 15 | -0.54 | 1.15 | -0.18 | -11.28 |

| 2016年8月1日 | 5530 | 1321 | 0 | -1 | 0 | -0.08 | -0.18 | -11.34 |

| 2016年8月2日 | 5530 | 1300 | 0 | -21 | 0 | -1.59 | -0.18 | -12.75 |

| 2016年8月3日 | 5530 | 1271 | 0 | -29 | 0 | -2.23 | -0.18 | -14.7 |

| 2016年8月4日 | 5530 | 1282 | 0 | 11 | 0 | 0.87 | -0.18 | -13.96 |

| 2016年8月5日 | 5530 | 1279 | 0 | -3 | 0 | -0.23 | -0.18 | -14.16 |

| 2016年8月8日 | 5370 | 1305 | -160 | 26 | -2.89 | 2.03 | -3.07 | -12.42 |

| 2016年8月9日 | 5370 | 1317 | 0 | 12 | 0 | 0.92 | -3.07 | -11.61 |

| 2016年8月10日 | 5370 | 1314 | 0 | -3 | 0 | -0.23 | -3.07 | -11.81 |

| 2016年8月12日 | 5370 | 1323 | 0 | 9 | 0 | 0.68 | -3.07 | -11.21 |

| 2016年8月15日 | 5370 | 1316 | 0 | -7 | 0 | -0.53 | -3.07 | -11.68 |

| 2016年8月16日 | 5370 | 1298 | 0 | -18 | 0 | -1.37 | -3.07 | -12.89 |

| 2016年8月17日 | 5370 | 1311 | 0 | 13 | 0 | 1 | -3.07 | -12.01 |

| 2016年8月18日 | 5370 | 1290 | 0 | -21 | 0 | -1.6 | -3.07 | -13.42 |

| 2016年8月19日 | 5370 | 1295 | 0 | 5 | 0 | 0.39 | -3.07 | -13.09 |

| 2016年8月22日 | 5370 | 1303 | 0 | 8 | 0 | 0.62 | -3.07 | -12.55 |

| 2016年8月23日 | 5370 | 1297 | 0 | -6 | 0 | -0.46 | -3.07 | -12.95 |

| 2016年8月24日 | 5360 | 1306 | -10 | 9 | -0.19 | 0.69 | -3.25 | -12.35 |

| 2016年8月25日 | 5360 | 1304 | 0 | -2 | 0 | -0.15 | -3.25 | -12.48 |

| 2016年8月26日 | 5300 | 1287 | -60 | -17 | -1.12 | -1.3 | -4.33 | -13.62 |

| 2016年8月29日 | 5390 | 1313 | 90 | 26 | 1.7 | 2.02 | -2.71 | -11.88 |

| 2016年8月30日 | 5390 | 1312 | 0 | -1 | 0 | -0.08 | -2.71 | -11.95 |

| 2016年8月31日 | 5390 | 1329 | 0 | 17 | 0 | 1.3 | -2.71 | -10.81 |

| 2016年9月1日 | 5390 | 1337 | 0 | 8 | 0 | 0.6 | -2.71 | -10.27 |

| 2016年9月2日 | 5450 | 1340 | 60 | 3 | 1.11 | 0.22 | -1.62 | -10.07 |

| 2016年9月5日 | 5450 | 1343 | 0 | 3 | 0 | 0.22 | -1.62 | -9.87 |

| 2016年9月6日 | 5450 | 1352 | 0 | 9 | 0 | 0.67 | -1.62 | -9.26 |

| 2016年9月7日 | 5450 | 1349 | 0 | -3 | 0 | -0.22 | -1.62 | -9.46 |

| 2016年9月8日 | 5450 | 1345 | 0 | -4 | 0 | -0.3 | -1.62 | -9.73 |

| 2016年9月9日 | 5520 | 1343 | 70 | -2 | 1.28 | -0.15 | -0.36 | -9.87 |

| 2016年9月12日 | 5520 | 1323 | 0 | -20 | 0 | -1.49 | -0.36 | -11.21 |

| 2016年9月13日 | 5400 | 1322 | -120 | -1 | -2.17 | -0.08 | -2.53 | -11.28 |

| 2016年9月14日 | 5400 | 1314 | 0 | -8 | 0 | -0.61 | -2.53 | -11.81 |

| 2016年9月15日 | 5770 | 1301 | 370 | -13 | 6.85 | -0.99 | 4.15 | -12.68 |

| 2016年9月16日 | 5770 | 1311 | 0 | 10 | 0 | 0.77 | 4.15 | -12.01 |

| 2016年9月20日 | 5240 | 1316 | -530 | 5 | -9.19 | 0.38 | -5.42 | -11.68 |

| 2016年9月21日 | 5240 | 1352 | 0 | 36 | 0 | 2.74 | -5.42 | -9.26 |

| 2016年9月23日 | 5380 | 1349 | 140 | -3 | 2.67 | -0.22 | -2.89 | -9.46 |

| 日付 | (1)終値 | (2)終値 | (1)前日比 | (2)前日比 | (1)騰落率 | (2)騰落率 | (1)PF | (2)PF |

Copyright (c) 2014 かぶれん. All Rights Reserved. プライバシーポリシー